Pet insurance helps cover the cost of medical care for your pet. It gives peace of mind knowing you can afford treatment if your pet gets sick or injured. Vet bills can be expensive, and emergencies often come without warning. Having insurance means you can focus on your pet’s health instead of worrying about money. It also helps with regular checkups and preventive care, keeping your pet healthy in the long run.

The monthly cost of pet insurance matters because it affects your budget. Knowing how much you’ll pay each month helps you plan your expenses better. A small, steady payment is easier to manage than large, sudden bills. Understanding these costs helps you choose the right plan that fits your needs and budget.

Table of Contents

Average Monthly Cost of Pet Insurance

The average monthly cost of pet insurance depends on the type of pet and the coverage you choose. For dogs, most accident and illness plans usually range between $50 and $65 per month. Cats are generally cheaper to insure, costing around $30 to $35 per month. These prices can vary from one insurance provider to another, depending on the level of protection and added benefits you select.

If you want a more affordable option, accident-only plans are available. These usually cost less because they don’t cover illnesses or preventive care. On average, accident-only coverage may cost $15 to $25 a month for dogs and around $10 to $20 for cats. Such plans are helpful for pet owners who want basic protection against emergencies without spending too much every month.

Factors That Affect Pet Insurance Cost

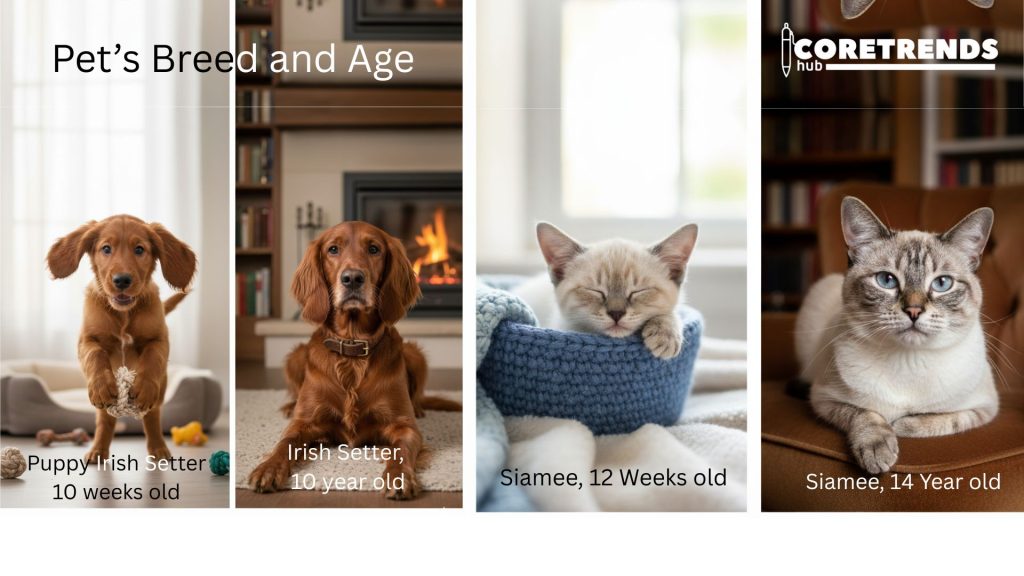

Pet’s Breed and Age

Your pet’s breed and age are two major factors that affect insurance costs. Some breeds are more likely to develop certain health issues, making them more expensive to insure. Larger dog breeds or purebred animals often have higher premiums. Age also matters because younger pets usually have lower monthly costs, while older pets cost more to insure as they face higher risks of illness and injury.

Location and Veterinary Costs

Where you live plays a big role in determining your pet insurance premium. Areas with higher veterinary costs lead to higher insurance rates. Urban locations or regions with expensive medical services usually have higher monthly fees compared to rural areas. This difference reflects the cost of local pet care and medical treatments.

Type of Coverage

The kind of plan you choose has a strong impact on your monthly cost. Accident-only coverage is the most affordable option, while accident and illness plans provide broader protection but cost more. Some owners also add wellness or preventive care options, which increase the total premium.

Deductible and Reimbursement Rate

Your deductible and reimbursement percentage also influence your overall cost. A higher deductible means you pay less each month but more when filing a claim. A lower deductible increases your monthly payment but reduces out-of-pocket expenses during treatment. Finding the right balance helps manage both short-term and long-term costs.

Pet’s Health History

Some insurance companies consider your pet’s health background when setting prices. Pets with previous illnesses or chronic conditions may have higher premiums or limited coverage. Providing accurate medical information helps you get the best plan suited to your pet’s current health.

Cost Difference Between Dogs and Cats

Pet insurance for dogs usually costs more than for cats. On average, accident and illness plans for dogs can be around sixty dollars per month, while similar coverage for cats often falls between thirty and thirty-five dollars. Dogs typically need more frequent vet visits, may face more injuries, and some breeds are prone to genetic health problems, which raises their insurance cost.

Cats generally have fewer serious health issues, especially indoor cats that are less exposed to accidents or injuries. This makes cat insurance cheaper compared to dogs. Even when looking at specific breeds, the price difference among cats is usually smaller than it is among dogs.

The size and lifestyle of the pet also affect the monthly cost. Larger dogs often require more extensive medical care, while smaller cats and dogs have simpler needs. Vet treatment prices, surgeries, and medications for dogs tend to be higher, contributing to higher premiums.

Price Comparison by Pet Breed

Price Comparison by Dog Breed

The cost of insuring dogs can vary widely depending on the breed. Large breeds, like Mastiffs and Standard Schnauzers, often have the highest insurance premiums because they are more likely to face serious health issues such as hip problems or heart conditions. On average, these breeds may cost over two thousand dollars annually for full coverage.

Smaller dogs and mixed breeds usually have lower insurance costs. Mixed-breed dogs tend to have fewer hereditary health issues, making their premiums more affordable, often between twenty-five and forty dollars per month. Breeds like Maltese or Border Collies are generally healthy, which also helps keep monthly insurance costs lower.

Price Comparison by Cat Breed

Cat insurance costs can also differ depending on the breed. Mixed-breed cats, like Domestic Shorthairs, usually have lower premiums, often ranging from twenty to twenty-eight dollars per month, because they are less prone to inherited health problems.

Purebred cats, such as Persians or Maine Coons, are more likely to develop genetic conditions like kidney or heart disease. This increases their insurance costs, which can range from thirty-five to fifty-five dollars per month. Knowing these differences helps cat owners choose the right plan for their pet’s health and budget.

Coverage Types and Their Impact on Price

Accident-Only Coverage

Accident-only plans are the most affordable type of pet insurance. They cover injuries from accidents, such as broken bones or cuts, but do not pay for illnesses. These plans are suitable for pet owners who want basic protection and lower monthly costs.

Accident and Illness Coverage

Accident and illness plans provide more comprehensive protection. They cover both injuries and common illnesses, including chronic conditions and infections. Because they cover a wider range of risks, these plans usually have higher monthly premiums compared to accident-only coverage.

Wellness and Preventive Care Add-Ons

Some insurance providers offer wellness or preventive care options. These add-ons cover routine vet visits, vaccinations, and dental care. Including these benefits increases the monthly cost but can help manage regular healthcare expenses more easily.

How Age and Location Influence Monthly Premiums

Your pet’s age plays a major role in determining insurance costs. Younger pets usually have lower monthly premiums because they are generally healthier and less likely to develop serious medical issues. As pets get older, the risk of illness and injury increases, which raises the cost of insurance. Some insurers may also limit coverage or increase rates for senior pets.

Location is another important factor. Veterinary care costs vary depending on where you live. Pets in urban areas or regions with higher vet fees often have more expensive insurance premiums compared to pets in rural areas. The cost of medical treatments, surgeries, and routine care in your region directly affects how much you pay each month.

Considering both age and location helps pet owners plan for insurance costs more effectively. Younger pets in areas with lower vet costs tend to have the most affordable premiums, while older pets in high-cost regions may require higher monthly payments.

Ways to Lower Pet Insurance Costs

Choose a Higher Deductible

Opting for a higher deductible can significantly lower your monthly pet insurance payment. This means your monthly bills will be smaller, making the plan easier to fit into your budget. However, you will need to pay more out of pocket whenever your pet requires treatment, so it’s important to balance the deductible with your ability to cover unexpected vet costs.

Compare Quotes from Different Providers

Insurance premiums can differ greatly between companies, even for similar coverage. By comparing quotes from multiple providers, you can find the plan that offers the best value. Look closely at what each plan covers, including accidents, illnesses, and optional add-ons, to make sure you’re getting the protection you need without overpaying.

Take Advantage of Discounts

Many insurers provide discounts that can lower your monthly premiums. Common ways to save include insuring more than one pet, paying the annual premium in full instead of monthly, or keeping your pet healthy with no pre-existing conditions. Some companies also offer loyalty discounts for long-term policyholders.

Maintain Your Pet’s Health

A healthy pet is less likely to develop serious medical issues, which helps keep insurance costs lower. Regular checkups, vaccinations, dental care, and a balanced diet can prevent illnesses and injuries. Staying proactive with your pet’s health not only protects your pet but also helps maintain more stable insurance premiums over time.

Conclusion

Pet insurance costs vary depending on your pet, their age, breed, and the type of coverage you choose. Dogs usually cost more to insure than cats, and older pets have higher premiums. Location, deductibles, and optional add-ons also affect the monthly price.

Understanding these factors helps you pick a plan that fits your budget and your pet’s needs. Comparing providers, choosing the right coverage, and keeping your pet healthy can lower costs. In the end, pet insurance provides financial protection and peace of mind, helping you give your pet the care they need without worrying about high vet bills.